When we first bought our house about seven years ago, our to-do list, based in part on our lengthy, detailed home inspection report, was literally pages long. More like a…

Are solar panels worth it? For us, absolutely.

Update, as of June 2023: Yes, solar panels are still totally worth it. There’s one thing I do wish we’d done differently, though: I wish we’d installed more capacity than we needed back in 2017, as we’ve since installed electric heat pumps to use less gas, replaced a gas dryer with an electric one, and plan to get an electric vehicle for our next car. Our solar provider gave us two quotes: One that met our existing electricity use, and one that would have maxed out our roof’s solar potential, which seemed like overkill at the time. But now I’d recommend installing more capacity than you currently need, as it will help in converting your home systems from fossil fuels to renewable electricity, which we’ll all need to do going forward. Ok, on to the original post…

In a piece I wrote for the Boston Globe a few years ago, I researched the cost and benefits of installing rooftop solar panels on your home. In the process, I learned a ton about the solar energy industry, the various tax and legal incentives in place to encourage homeowners to go solar, and how to crunch all the numbers involved.

So, are solar panels worth it?

Good grief, yes! At least, here in Massachusetts they sure are. And that yes comes with some other important caveats – chief among them, not everyone’s roof is right for solar. But ours was, and after researching that article with a pretty open mind, I was convinced that we needed to go solar – and pronto.

So we did, although it took us a while. We got quotes from a few different installers through EnergySage.com, and had enough solar panels installed this past winter to provide power to both units in our two-family. (The election of a certain environmentally antagonistic president and the overwhelming need to do something tangible in response to his withdrawal from the Paris Climate Accord was the clincher on our decision.)

Here’s why solar panels are usually worth the cost — if your roof gets a lot of sun, and is in good condition — and a look at our experience getting rooftop solar installed.

Why go solar?

The idea of producing electricity from the sun’s rays — which are just hanging out up there in the sky all day anyway, being hot and bright and full of energy whether you do anything with them or not – holds a pretty undeniable appeal to people of all walks of life.

Whether you’re an off-the-grid doomsday prepper, a tree-worshipping environmentalist, or just someone who wants to use less fossil fuel and maybe do a little something to help out our beautiful Mother Earth, rooftop solar is an attractively simple option.

But, it can cost quite a bit of money upfront. Now, we’re the type of people who are willing to pay extra to help the environment – it’s a major concern for my wife and me. Through National Grid’s ‘Green Up’ program, we used to pay bit extra on our bill each month to ensure that 100% of our electricity came from renewable sources. But not everyone’s like that, or able to afford it, and that’s totally understandable.

Here’s the good news: In Massachusetts, at least, an investment is solar panels is well worth it, and usually pays itself off in just four or five years. After that, you’ve got free electricity for another decade or two. That makes sense whether you care about the environment or not.

Here’s why solar makes so much practical sense in Massachusetts (this goes for some other Northeastern states with similar laws and incentives in place as well):

- Energy here is expensive. Well duh. Everything here is wicked expensive, from houses to baseball tickets. But because our baseline electricity costs are among the highest in the country, it makes free solar power all the more attractive compared to places where electricity is cheap. You’ll break even on your investment much, much faster.

- We have net metering. Net metering means that you get direct credit off your bill for every kilowatt hour of electricity you produce and send into the grid. People with solar panels produce more energy in summer and during the day, and receive credit for that, which they can apply to their bill at night and in winter. This is the fundamental economic motivator when it comes to encouraging solar adoption, but some states are trying to tinker with it or abandon it altogether, because the utility companies don’t like it. (At some point, it might make sense to charge solar customers a “grid fee” for the luxury of getting power when they’re not producing it, though advances in battery technology may negate the need for that entirely.) But for now, it remains in place here in Massachusetts and isn’t expected to change for residential installations. (And most experts I’ve spoken to say that, even if net metering were to go away in the future, anyone who installed solar panels while it was still in effect would remain eligible for it.)

- There are considerable tax rebates. The biggest tax incentive for installing solar is the 30% kickback you’ll get from the federal government. It had dropped to 26% in 2022, and was scheduled to disappear altogether in 2024, but the Inflation Reduction Act enshrined an uncapped 30% tax credit for rooftop solar for the foreseeable future. Massachusetts kicks in an additional 15% (up to $1,000) at the state level. So if a solar array costs $20,000 to install, you’ll receive $5,200 back from Uncle Sam and another $1,000 back from Massachusetts, bringing the net cost down to $13,800.

- Plus, there’s the SMART program. We installed our panels early enough that we were able to get into the Massachusetts SREC program, which allows solar-producing homeowners to sell clean energy credits back to the utility — meaning we actually make a few hundred bucks each quarter on top of our net-metering savings. The state has phased out that program, but still rewards homeowners who install solar through its SMART program, which similarly pays solar-generating households a small amount per kilowatt-hour produced. A typical residential array can earn its owner about a thousand bucks a year for 10 years.

- It can increase your home’s value. A few studies have shown that solar panels generally improve the value of a home — though this isn’t true for leased panels, which can create minor headaches around lease transfers when you go to sell. But if you own the system outright and it’s in good condition, most potential home buyers will see the benefit of not paying for electricity for the next decade or more.

- We get a surprising amount of sun — and crisp, cold days. It may surprise you, but going solar makes just as much sense in Massachusetts — home of monster Nor’easters — as the sun-soaked desert hellscape they call Arizona. (Did I say that out loud? Sorry, I don’t like the heat.) That’s because solar panels, like a lot of electronics, operate more efficiently in cool weather. I’ve noticed this on our own rooftop array — we hit peak production several times in April and May, but rarely got anywhere near it on the hot sunny days of July and August.

Anyway, there are a lot of reasons solar makes sense. All told, homeowners who install solar panels can save tens of thousands of dollars over 20 years.

In my Globe article, I wrote, “Imagine spending $15,000 to remodel your bathroom and getting a fancy new eco-friendly faucet that spits out money for the next 20 years.” That might seem a bit much, but it really is a fair comparison: Installing rooftop solar can boost your home’s value as much as a kitchen remodel, and it turns your house into a green power plant that literally pays you money. Not even a fancy SubZero fridge offers that feature.

How much do solar panels cost?

Getting those savings requires an upfront investment, of course. The average 5 kilowatt rooftop solar system costs about $17,800 installed, according to EnergySage. But that’s before the many tax credits and other incentives are factored in.

And at a time when inflation is pushing the price of nearly everything much higher, and quickly, the cost of solar has actually been dropping or holding steady for years.

Meanwhile, you can usually fiddle with the numbers until your loan payment is roughly equal to what you were paying for electricity. So in practical budgeting terms, you won’t see much of a cost difference at first, and then eventually you’ll get years of free electricity.

Buy your solar panels if you can (don’t lease them).

You can go solar with little or no upfront cost by leasing your panels — this is where a company like SolarCity or SunRun installs the panels on your roof, and sells you the solar power they produce (generally at a lower rate than your utility company charges).

They take care of the installation and any future repairs or maintenance (though there usually isn’t much of that to worry about). When the lease is up, after 20 years or so, you can either renew it or they’ll come and take the panels off free of charge.

Leasing is a cheap and easy way to go green and save money on your electric bill at the same time, which makes it pretty appealing. However, when you lease, the company keeps all the tax benefits — this is why it works out for everybody – and it makes selling your home a little more complicated (you either have to buy yourself out of the lease, or sign it over to the buyer).

You’ll save a lot more money over the long run if you can purchase your panels outright with a home equity loan or other financing.

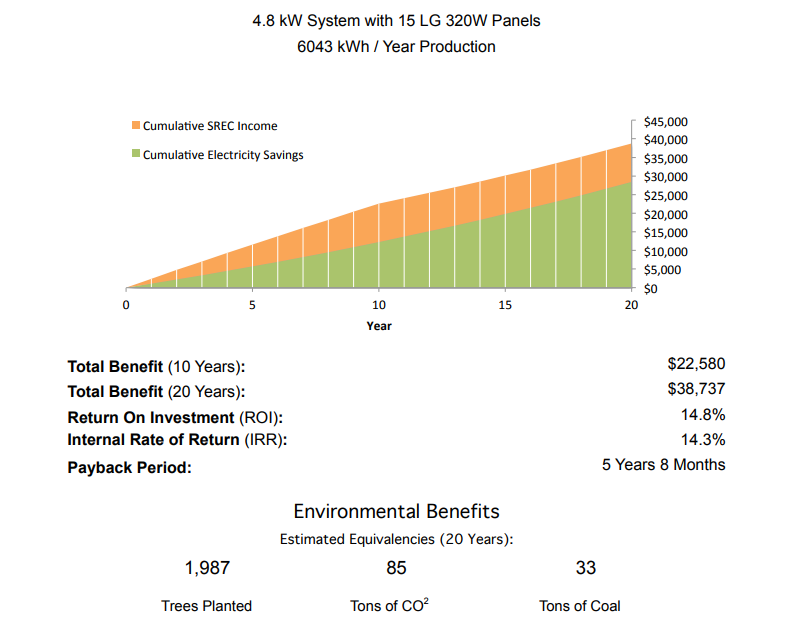

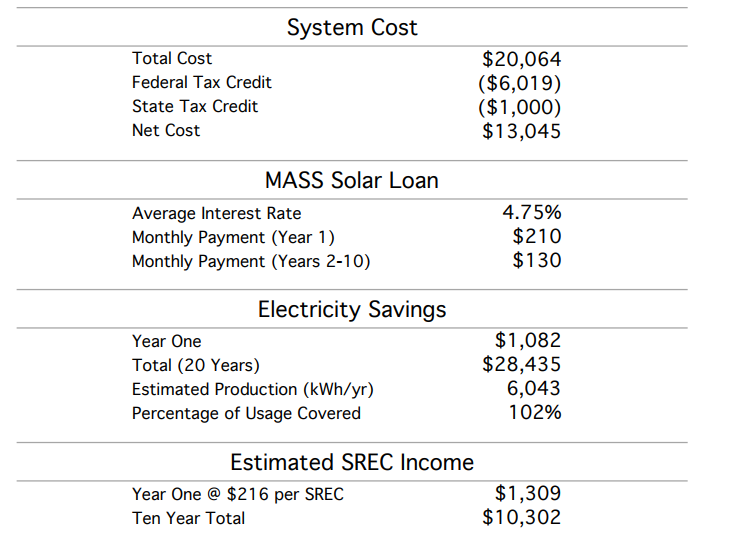

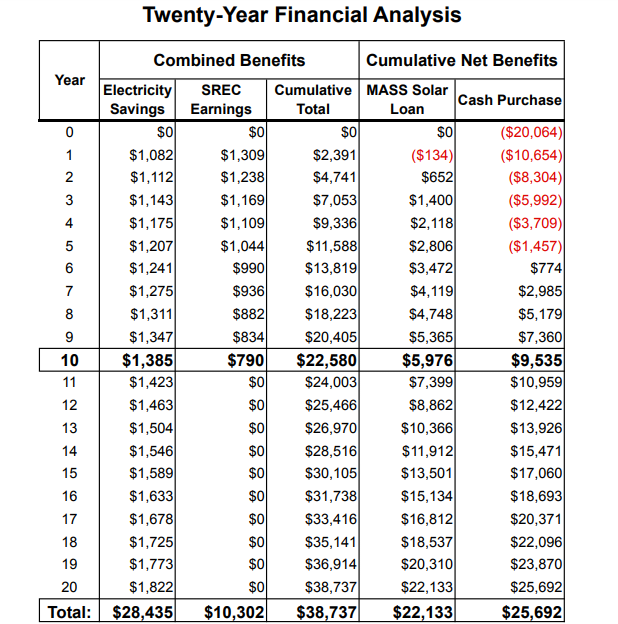

Here’s how the numbers worked for us in real life:

Our combined electric bill for both units was about $110/month. We installed 15 solar panels and it cost about $20,500 before any tax credits – that’s the amount we took out through a Massachusetts solar loan.

Our payment started at about $195/month — so, higher than our electric bill, but not crazy higher. When we got our tax kickbacks (about $6,000 federal, plus another $1,000 from Massachusetts), we were able to put that chunk of money toward the solar loan reducing the payment to about $120/month for the following nine years.

Still higher – but because electricity rates tend to rise a few percent each year, in a few years that $120/month will probably be lower than our bill would have been otherwise. More importantly, because the panels are guaranteed for 20 years (and often last longer than that), we’ll be raking in completely free electricity for a solid 10 years or more once the loan is paid off. Even at today’s electric rates (which will only go up), that’s worth about $1,400 a year.

And to sweeten the pot, we’ve been earning about $200-$250 for each 1.25 MW of electricity we produce (about $1,000 to $1,250 per year). While that will eventually phase out (we’ll keep earning SREC income through Year 10, but it slowly drops), it helps offset (or actually completely offsets) the higher first-year payment.

Here’s a look at the quote we received from Great Sky Solar. Some of these numbers ended up a bit different, because we bought a “point” on our loan to lower the interest rate. (Basically we paid $200 upfront to lower the rate down to like 3.5% or something quite low, and that lowered our monthly payment for the entire life of the loan.)

Step-by-step guide to going solar

Have I convinced you yet? (It’s not hard – I feel like solar panel salespeople have the easiest job in the world right now.) Here’s what to do if you’re interested in getting rooftop solar panels.

Step 1: Check your sun.

This is important, because solar will only make sense if your roof is right for it. Generally, you want a large portion of your roof facing south, southwest, or southeast, without a lot of trees in the way. Enter your address into Google’s Project Sunroof tool, and it will calculate how much sunshine your roof gets and how much space is available for panels. Our roof is big, basic, and faces south, with plenty of sun from about 11am ’til sunset, so we were good candidates.

Step 2: Fix your roof, if needed.

Because your solar panels will last 20 years or more, and a new roof generally lasts 20 to 30 years, installers will usually only put in panels if your roof is under 10 years old and in good condition. (We had replaced our roof about five years prior, so it was all ready for panels.) Of course, if you need both a new roof and solar at the same time, you could consider getting Tesla’s new solar roof — an entire roof comprised of solar panel shingles. Very cool, but pretty expensive.

Step 3: Time it right, if possible.

Ideally, you want to get your system installed in time for spring. The long days of April, May, and June will help you bank lots of net metering credits for the leaner winter months. That means you want to get the process started over the winter if possible, because it might take a month or two before your preferred installer can fit you in.

Pay attention to the tax credit schedule, too. You can expect some backlogs as they begin to phase out after 2022 and people rush to get panels installed before that year’s end.

Step 4: Get quotes from a few installers.

We used EnergySage.com to get estimates from a handful of different installers, and found the process very simple and easy to understand. You can just upload a PDF of your current electric bill (or enter the data on it, like your annual electric usage), and several solar installers will get back to you with full quotes, good for 30 days in most cases, with estimates about what size system you need, what type of panels they recommend, how much money you’ll save, and the cost of installation.

Some companies will give you a nearly-instant quote based on satellite imagery of your roof, while others will want to come and measure the sunlight onsite. (Most will come visit before you finalize a contract, just to double check the satellite info and answer any questions.)

We ended up using Great Sky Solar, an employee-owned outfit comprised of some very thoughtful, friendly, and knowledgeable folks who used to work at bigger solar companies like SolarCity and were kind of jaded by their experiences there. They were great to work with and, while it took a few weeks to fit us in to their busy work schedule, they completed the entire installation in one day and helped us navigate the solar loan paperwork and utility hookup. Great Sky was also really careful about aesthetics, going out of their way to make sure the panels were centered on the roof and that the wiring was hidden as much as possible.

Step 5: Get financing.

If you’re buying your panels outright (as opposed to leasing them), you can generally take out a secured or unsecured loan to pay for the installation. A secured loan typically has lower interest rates because you put up some form of collateral the lender can claim should you default on your payments — that could be the panels themselves or, in the case of a home equity loan, a lien on your home. Plenty of lenders specialize in loans specifically geared toward solar projects — EnergySage lists some of them here.

Step 6: Flip the switch (once you get the OK).

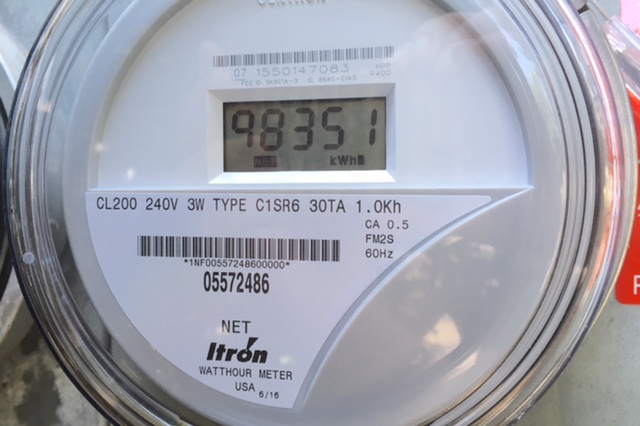

After your solar panel installation is complete, it can take a week or more for the utility company to approve the job and come install a two-way electric meter (which measures how much power you’re using and how much you’re feeding back into the grid).

If you try to turn on your system before then — and you can, it’s technically operational — you’ll end up paying dearly, because a traditional meter registers any current that passes through it. So when your panels are producing excess power and feeding it into the grid, a traditional meter would charge you for it rather than crediting your account.

So make sure you wait until the utility company installs a two-way meter and gives you the all clear. At that point, you can just flip the “off” switch to on, and start turning sunshine into electricity – and money.

Step 7: Watch your panels turn sunshine into electricity.

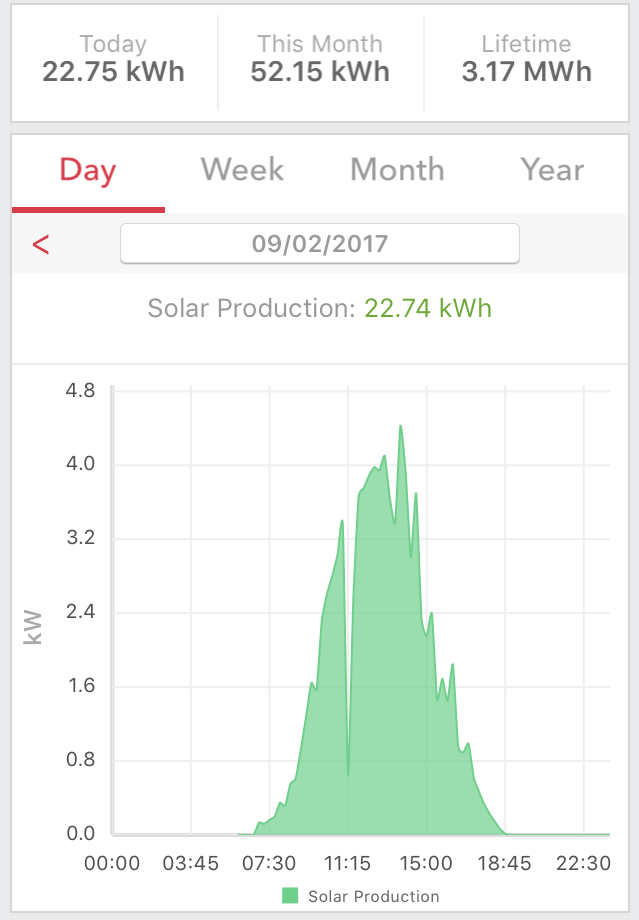

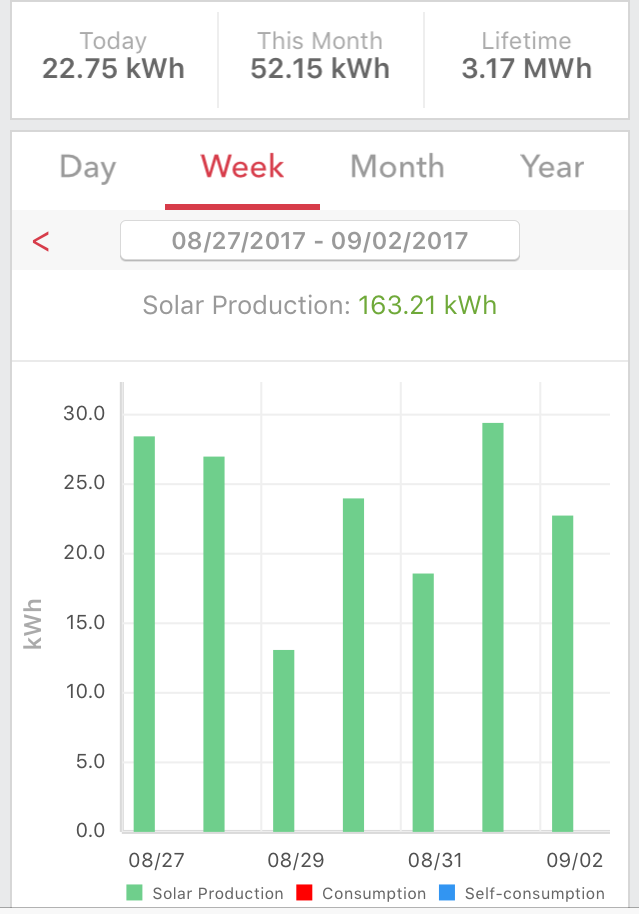

Once you’re all powered up, your installer should set you up with an app or website that allows you to track how much electricity you’re producing. This is weirdly addictive since you’re basically minting money, and you can see the fluctuations as clouds roll through on sunny days:

Here’s the weekly view:

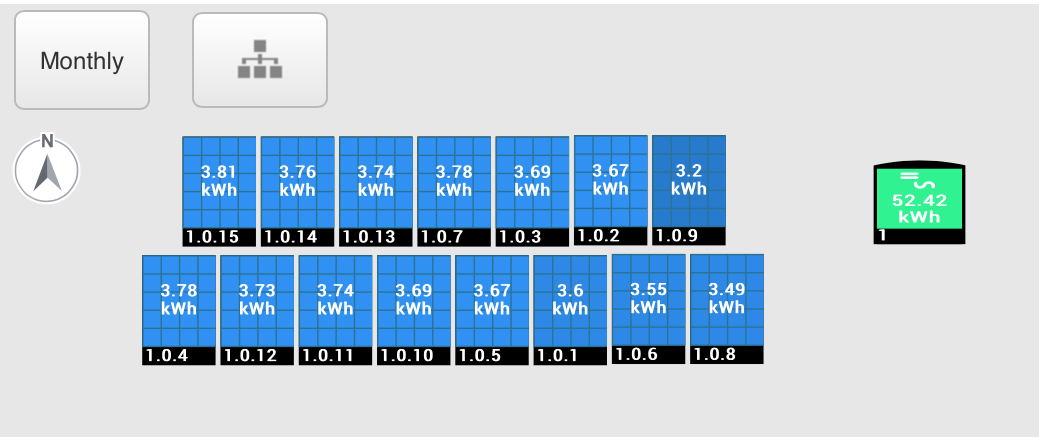

You can even see which panels are your MVPs, soaking up the most sun and producing the most energy day in and day out:

Finally, your two-way meter on the side of the house can show whether you’re in the black or the red electricity-wise. Ours started at 00,000 and is now at 98,351, meaning we’ve already banked (through net metering) 1,649 kWh of electricity for the darker days of winter:

Between both units, we use about 12 kWh of electricity a day, which means we’ve already banked a 137-day supply of electricity. And of course, your array still produces power on sunny winter days – just not as much.

So, are solar panels worth it?

It depends a lot on where you live, the condition and position of your roof, and whether you plan to stay in your home long enough to break even and reap the rewards of your free electricity. A comparison site like EnergySage can help you with the math and other influencing factors.

It also depends on whether you like the look of them. Personally, I think they look great on our hulking two-family — but if you’ve got a beautiful old Victorian, you’d probably want them on the back of the house, if at all. Here’s a before and after shot of our roof — if anything, it looks better (maybe one day we can get stupid DirecTV to take their satellite dish back).

But if you’re looking for a way to help the environment and save (or even make) money doing so, installing rooftop solar is one of the most slam-dunk ways to do so. In our case, installing solar panels was 100% worth it, and I couldn’t be happier.